ArcelorMittal’s Decarbonization Investments and European Expansion

ArcelorMittal continues to push forward with its decarbonization initiatives in France. The company has announced a €1.2 billion investment in an Electric Arc Furnace (EAF) at its Dunkirk facility. This marks a significant step in its sustainability efforts. This new investment increases ArcelorMittal’s overall commitment to its French operations, now totaling €2 billion. Additionally, the company has invested €254 million in Dunkirk and €53 million in Fos-sur-Mer. These investments underline its ongoing push for greener production methods.

Additionally, the steelmaker is progressing with the construction of a new electrical steel production unit in Mardyck. This €500 million project is set for completion by the end of the year. ArcelorMittal had initially delayed these investments due to the challenges faced by the European steel sector. This sector has been experiencing what the company referred to as its “worst crisis since the financial crisis of 2009.”

However, with the European Commission’s Steel and Metals Action Plan, ArcelorMittal has expressed renewed optimism. This plan includes measures like carbon border adjustment mechanisms (CBAM) and efficient trade defense. As a result, the company has requested the European Commission to limit imports to 15% of market demand. This aims to protect the local steel industry.

Salzgitter and Saritas Celik’s Investments in European Steel

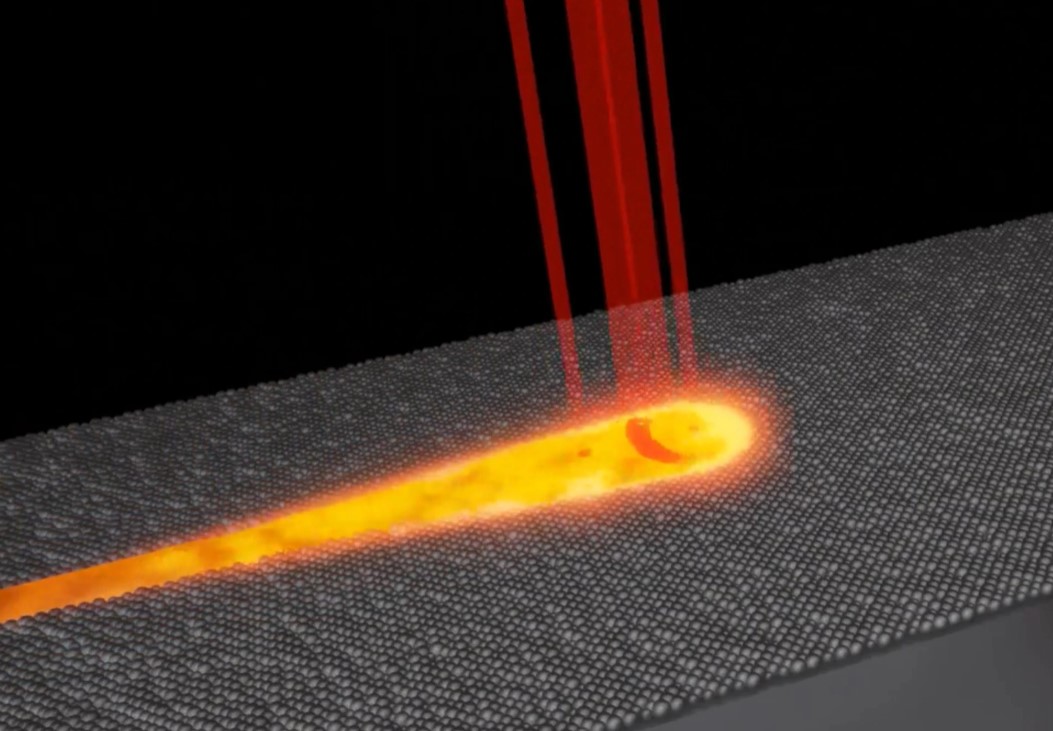

Salzgitter Flachstahl, a key player in the European steel market, is investing in green technologies. The company plans to install a new walking beam furnace and waste gas heat recovery system at its hot strip mill in Salzgitter, Germany. The project, due for completion by 2028, aims to cut slab heating energy consumption by up to 30%. This significantly reduces its carbon footprint. The initiative is part of Salzgitter’s broader strategy to reduce energy consumption and carbon emissions. This aligns with Europe’s green steel push.

Meanwhile, Saritas Celik in Turkey is advancing the construction of a new stainless steel production facility in Yalova. This project will be implemented in stages. The first cold rolling mills are expected to be operational by 2027. Upon completion by 2030, the facility will have an annual capacity of 800,000 tonnes. This will contribute significantly to Turkey’s steel production capabilities.

North American and Asian Steel Developments

In North America, Cleveland-Cliffs has announced plans to close several non-core steelmaking operations by June 30, 2025. This decision, driven by weak demand and persistent losses, will affect facilities in Steelton, Pennsylvania, Riverdale, Illinois, and Conshohocken, Pennsylvania. These closures are part of Cleveland-Cliffs’ strategy to focus on automotive steel production and reduce fixed costs. The company expects to save up to $350 million annually through these actions.

On the other side of the world, Shagang Group in China has placed an order for a second cold rolling mill at its facility in Jiangsu province. This new mill will produce 80,000 tonnes per year of non-grain oriented electrical steel, primarily for high-performance electric motors. The commissioning of the mill is expected in 2026.

Japan’s Chiyoda Steel is also making strides with the installation of a new ladle furnace and endless casting rebar rolling mill at its Ayase facility. This new equipment will enable the production of up to 430,000 tonnes of rebar annually. It meets the growing demand for construction materials. The project is set for completion later this year.

Godo Steel’s Technological Upgrades in Japan

In a significant technological upgrade, Godo Steel has contracted Danieli to modernize its medium section rolling mill at the Himeji plant. The $90 million investment will install shiftable double-stand reversing mills. These are scheduled to go into service by late 2028. The investment aims to replace equipment in service since 1938. This ensures the continued competitiveness of Godo Steel in the global market.

SuperMetalPrice Commentary:

The ongoing investments in decarbonization and steel production upgrades in Europe, North America, and Asia underscore the steel industry’s commitment to sustainability and innovation. ArcelorMittal’s €1.2 billion investment in France and the advancements in Turkish and Chinese steel facilities highlight a global shift toward greener, more efficient steelmaking. These efforts, combined with new technological upgrades, will help address environmental concerns. They also aim to meet the growing demand for high-performance steel in industries like automotive and construction.

The strategic closures and investments by companies like Cleveland-Cliffs and Godo Steel indicate a broader trend in the steel sector. This trend focuses on the most profitable and sustainable areas. It involves modernizing facilities to stay competitive. As the global steel industry adapts to these new realities, we can expect significant changes. These will occur in production methods, supply chains, and market dynamics in the coming years.

Leave a Reply

You must be logged in to post a comment.